|

Kloten/Stein am Rhein, 11 August 2020. The Phoenix Mecano Group's half-year results reveal the significant impact of the COVID-19 pandemic. As a precautionary measure to protect employees, the company temporarily closed some production facilities. All plants are now operating again, although some are working at reduced capacity or with major fluctuations in capacity utilisation. As a result of the global economic downturn, propensity to invest declined in the Group's end markets in the second quarter.

Despite these difficult conditions, Phoenix Mecano pushed ahead resolutely with its strategic projects. The Group completed the acquisition and integration of MyHome and made initial investments in the industrial complex of DewertOkin Technology Group Co. in Jiaxing, south-west of Shanghai.

In a global market environment hit hard by the COVID-19 pandemic, the Phoenix Mecano Group's sales and incoming orders declined in the first half of 2020, and the operating result fell disproportionately. In response to the pandemic, Phoenix Mecano immediately expanded and stepped up the performance enhancement programme under way since 2019. In addition, short-time working was introduced in many places and non-operating expenses were reduced.

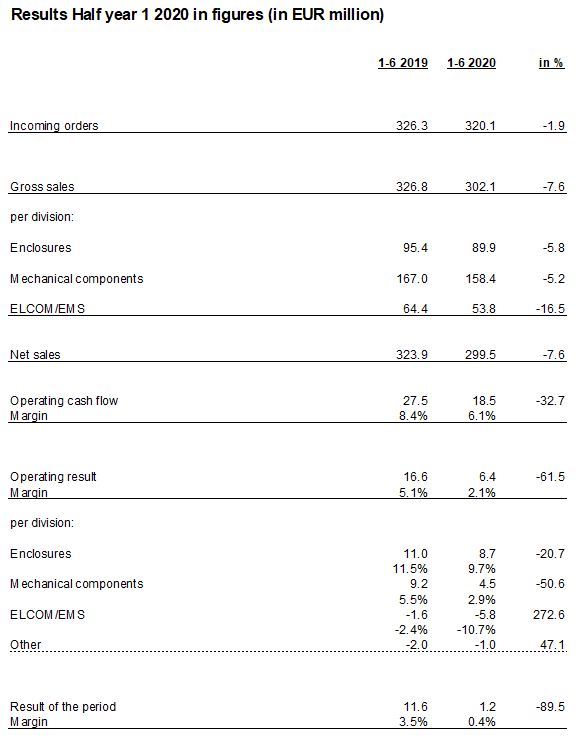

Consolidated gross sales fell by 7.6% in the first half of 2020, from EUR 326.8 million to EUR 302.1 million. In organic, local-currency terms, the decline was 10.7%. Net sales totalled EUR 299.5 million (previous year EUR 323.9 million). Incoming orders decreased by 1.9% from EUR 326.3 million to EUR 320.1 million. The book-to-bill ratio was 106.0% (previous year 99.9%).

The operating result was down by 61.5% from EUR 16.6 million to EUR 6.4 million, while the operating cash flow fell by 32.7% from EUR 27.5 million to EUR 18.5 million. The operating result includes subsequent one-off expenses of EUR 2.1 million from the performance enhancement programme launched in 2019, a number of whose measures have been stepped up. One-off expenses of EUR 1.4 million from the performance enhancement programme were included in the previous year's operating result.

The result of the period after taxes was EUR 1.2 million, down 89.5% on the previous year (EUR 11.6 million). The financial result fell by EUR 2.2 million year-on-year, mainly due to exchange-rate changes and currency hedging costs. At EUR 102.6 million, net indebtedness remained at a similar level to 30 June 2019 (EUR 103.2 million). The equity ratio was 43.3%, with the balance sheet free of goodwill.

Development of the Group's divisions

The Enclosures division was able to hold its own in a challenging market environment. Sales fell by 5.8% to EUR 89.9 million. Organic, local-currency sales were down by 8.5%. In its most important market, Germany, sales remained stable due to acquisition activity. The UK and Italy, both heavily impacted by the COVID-19 crisis, saw a double-digit percentage drop in sales. Sales were also down in other European markets, as well as in the Middle and Far East (-18.6%) and North and South America (-7.7%).

Demand for industrial enclosures declined in the traffic engineering, measurement and control technology, and mechanical and plant engineering sectors. In Asia, a drop in investment confidence in the oil and gas business was reflected in sales figures. By contrast, sales of operating units and electronic enclosures with state-of-the-art input systems remained almost unchanged. The operating result fell by 20.7% to EUR 8.7 million, with a corresponding reduction in operating margin from 11.5% to 9.7%. In China, the enclosures business was concentrated at a single site in Shanghai.

The Mechanical Components division saw gross sales decline by 5.2% to EUR 158.4 million. In organic, local-currency terms, they were down by 9.7%.

Both the industrial segment and the furniture and healthcare market recorded lower sales. Growth in the Americas and Asia slowed abruptly in the second quarter as customers in the furniture business had to close their factories for several weeks due to the pandemic. This decline was only partially offset by rising demand in the medical applications segment (Dewert) and in logistics for online business (Rose&Krieger).

The operating result decreased by 50.6% to EUR 4.5 million, while the operating margin shrank from 5.5% to 2.9%. As part of the package of measures to adjust capacity and streamline the product portfolio, further personnel adjustments were implemented. The associated one-off expenses impacted the division's H1 result by a total of approximately EUR 1 million.

Phoenix Mecano acquired the remaining shares in China-based Haining MyHome Mechanism Co., Ltd. ahead of schedule and successfully completed integration into the division. This acquisition means that customers can now purchase functional fittings and drive systems for adjustable armchairs from a single source. In a bid to concentrate its strategic and technological expertise, the Group pushed ahead with its investment in the DewertOkin Technology Group industrial complex in China.

In the ELCOM/EMS division, gross sales in the first half of 2020 fell by 16.5% to EUR 53.8 million. In organic, local-currency terms, they were down by 16.4%. All of the division's business areas recorded double-digit sales declines owing to the slump in demand in their industrial end markets, including the automotive and mechanical engineering sectors.

The operating loss was EUR 5.8 million, following an operating loss of EUR 1.6 million the previous year. The marked decline in sales combined with exceptional expenses for staff reductions and value adjustments on non-current and current assets resulted in losses in all three of the division's business areas. Phoenix Mecano successfully merged its production facilities in southern China at a new plant in Lechang, thereby eliminating duplications.

Outlook

The COVID-19 pandemic significantly dampened global capital goods activity in the second quarter. Phoenix Mecano's management reacted to the changed circumstances with immediate measures and additional structural adjustments, in order to cushion the negative impact on the business.

In the meantime, the industrial purchasing managers' indices have recovered somewhat in almost all countries, suggesting an improvement in the situation in H2. However, business development will depend to a large extent on how the pandemic evolves. The management continues to focus on liquidity and costs, but is also well prepared for a rapid economic recovery.

Phoenix Mecano expects the economic situation to remain challenging in the second half of the year. However, the Group is underpinned by a solid balance sheet structure and the modest decline in incoming orders and high book-to-bill ratio bode well. Barring any widespread second wave of contagion, the pandemic is likely to have less of an impact on the operating result in H2 than in H1, compared to the previous year.

Despite the challenging circumstances, Phoenix Mecano remains committed to pursuing forward-looking growth initiatives. For example, the Group is investing in strategic projects in the 'smart home' growth market and is further consolidating its market-leading position in system solutions and components for electrically adjustable upholstered furniture.

A detailed semi-annual report will be available for downloading as a PDF file from our website http://www.phoenix-mecano.com/en/investor-relations/annual-reports/semi-annual-reports from 11 August 2020.

|